In addition to information about Massachusetts' income tax brackets, provides a total of 127 Massachusetts income tax forms, as well as many federal income tax forms. Other Massachusetts Individual Income Tax Forms:

#Tax brackets 2022 massachusetts update#

We will update this page with a new version of the form for 2024 as soon as it is made available by the Massachusetts government. Multiply the result of Step 8 by 5.00 percent to obtain the annual Massachusetts tax withholding.

We will update this page with a new version of the form for 2024 as soon as it is made available by the. This form is for income earned in tax year 2022, with tax returns due in April 2023. The tax rate for Fiscal Year 2023 will not be approved. State Corporate Income Tax Rates and Brackets as of January 1, 2023. The rate will continue to decrease by 0.5 percentage points each year until it reaches 4.99 percent at the beginning of 2031. We last updated Massachusetts Schedule OJC in January 2023 from the Massachusetts Department of Revenue. The tax rate has been approved at 14.86 per thousand dollars of assessed value for all property. Due to the enactment of HB 1342 in 2022, Pennsylvania saw a rate reduction from 9.99 percent to 8.99 percent on January 1.

#Tax brackets 2022 massachusetts plus#

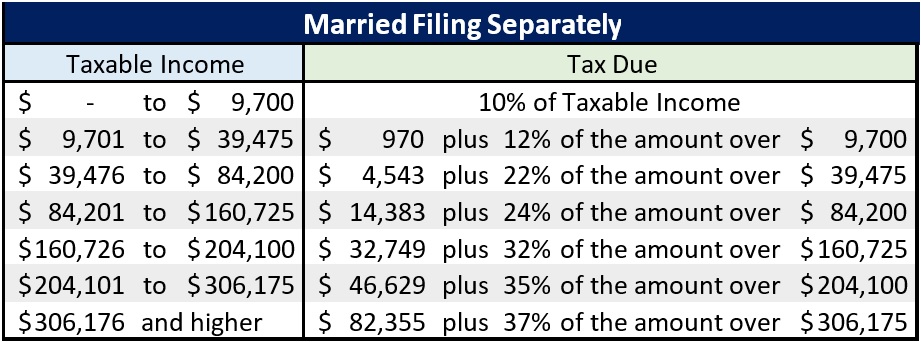

If the employee claims more than one exemption, deduct 1,000 times the number of exemptions plus > 3,400. More about the Massachusetts Schedule OJC. This form is for income earned in tax year 2022, with tax returns due in April 2023. If the employee claims one exemption only, deduct > 4,400 <. In addition to information about Massachusetts' income tax brackets, provides a total of 127 Massachusetts income tax forms, as well as many federal income tax forms.We last updated Massachusetts Schedule CB in January 2023 from the Massachusetts Department of Revenue. We will update this page with a new version of the form for 2024 as soon as it is made available by the. On Tuesday, voters in Massachusetts voted 'yes' on Ballot Question 1, approving the imposition of a 4 percent surtax on Massachusetts taxpayers with a net income in excess of 1 million.

This form is for income earned in tax year 2022, with tax returns due in April 2023. We last updated Massachusetts Schedule E Reconciliation in April 2023 from the Massachusetts Department of Revenue. We last updated Massachusetts Form MA 1099-HC in January 2023 from the Massachusetts Department of Revenue. We will update this page with a new version of the form for 2024 as soon as it is made available by the Massachusetts government. More about the Massachusetts Form MA 1099-HC.

We last updated Massachusetts Form 1-NR Instructions in January 2023 from the Massachusetts Department of Revenue.

0 kommentar(er)

0 kommentar(er)